More than a few clients have reached out to see what could be done to reduce their taxes. For some, a big tax bill is coming because of the sale of their business. For others, it was the sale of real estate. For still others, it was just a really great year given the many positive things happening in America economically. Regardless of the reason, we have found many in significant distress over the amount of taxes due.

For the last two years, a dear friend in the advanced planning arena has been after me to investigate Pooled Income Funds (PIF), and specifically – a “young” PIF … one less than three years old. I now understand why Randy was so excited about this planning technique, and I take solace in the knowledge that very few advisers, yet alone their clients, have even heard of this idea. So, here is a high-level “fly by” on the benefits and drawbacks of a “young” PIF – which will allow you to reduce your taxes, receive income, and at the same time, help the public good …”Imagine That™!”

What is a (Young) Pooled Income Fund?

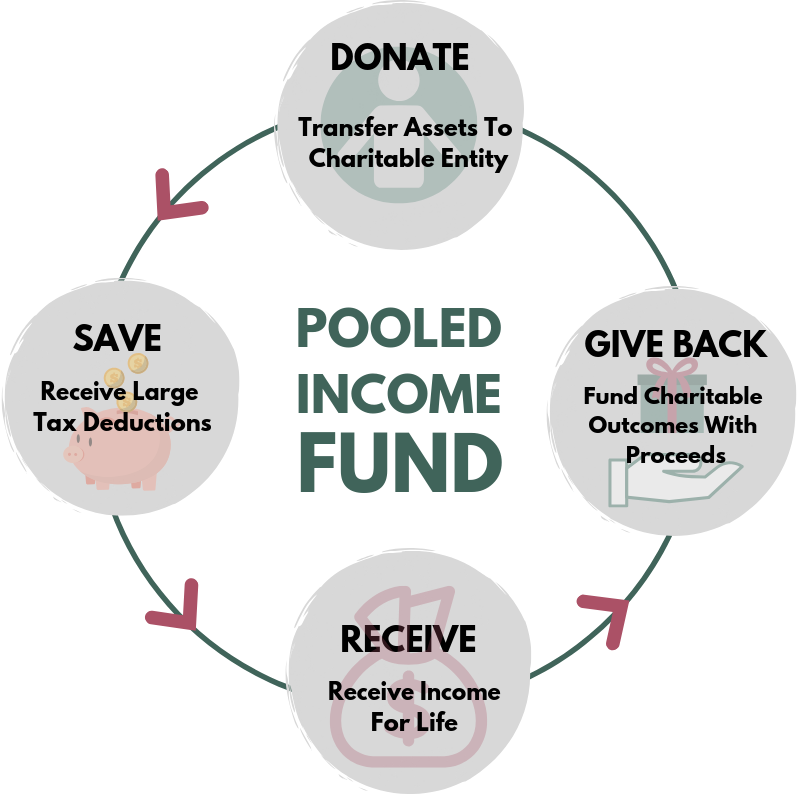

A Pooled Income Fund was first created as a result of the 1969 Tax Reform Act – so it has been around a long time in tax years. Specifically, it is a tax-exempt trust operated by a charity. Why is it called a “pooled” income fund? A charity receives donations from multiple parties, “pools” the donations together, invests and manages the assets, and pays income to the donors for their lifetimes. The donors receive a tax deduction in the year the donation occurs. After the donors (or income beneficiaries) die, the remaining portion of their donation is distributed to charities the donors have selected.

These old PIF’s are not in vogue because the income benefit is low, as well as the tax deductions generated. Something exciting happened, however, to make this “ho-hum” strategy into one worthy of being included in “The Justice League.” IRS now allows for a “variation on a theme” which has dramatically increased the size of the tax deduction – and allows for individual pools of funds rather than being aggregated with others. (To have your own custom (young) PIF usually requires $1 million or more of contribution.) This greater customization often creates a larger income stream for the recipient … instead of 3%, for example, we are seeing annual returns in the 5-7% range.

What’s so Attractive About a (Young) Pooled Income Fund?

There are five main benefits of a (young) PIF:

- Income Stream for Life—the (young) PIF pays an income stream to the donors for their lifetimes. Moreover, the donors can name additional beneficiaries such as a child or grandchild to receive lifetime income – while still receiving a significant charitable income tax deduction

- Income Tax Deduction—assets donated to the (young) PIF receive an income tax deduction in the year donated. The IRS calculations look at the fair market value of the donation, the ages of the donors (or income beneficiaries), and the IRS “valuation rate,” as opposed to the more typically used IRS discount rate. (“Boring!”)

- Eliminates Capital Gains Taxes on Appreciated Property—a contribution to the (young) PIF avoids capital gains taxes on appreciated property if donated prior to sale. For example, if you own stock in a company which has dramatically increased in value, in most cases, you can transfer the stock into the (young) PIF and eliminate capital gains taxes completely – leaving more for you to receive income from!

- Eliminates Federal Estate Taxes on Assets in the (Young) Pooled Income Fund—because the remaining value of assets will go to your family giving fund or other philanthropic outlet, the value of the remaining assets in the (young) PIF is not subject to the 40% Federal estate tax. (If the income stream, however, is multi-generational, the present value of the future income stream will be included when tallying the value potentially subject to Federal estate tax)

- Supporting Charities—after both donors (or income beneficiaries) die, the remaining assets are distributed to charities the donors desire to support – which could be your own family giving fund or private foundation

Are There Drawbacks to Using a (Young) PIF?

There are a few possible drawbacks when choosing a (young) PIF:

- Income Can Be Unpredictable—receiving lifetime income is a great perk but the amount of income received can be unpredictable. The income will depend on what types of investments are made by your financial adviser or the charity if not using an individual financial adviser on the account

- Income Received is Taxed as Regular Income—the income received from the (young) PIF is taxed as regular income, and in most cases, as long-term capital gains, too. For people who are trying to minimize their income because they already pay too much in taxes, this is a potential drawback. Because the (young) PIF generates a high tax deduction (69% for a male age 65, and 62% for a married couple age 65 in 2019), the taxable income can be offset by the deduction to a large degree for as long as six tax years

- Items of Contribution May Be Limited—depending on the (young) PIF you are interested in, some restrictive (young) PIFs only allow donations of cash, publicly traded stocks and bonds, and shares of mutual funds. We utilize charitable organizations that will also accept appreciated real estate or a privately held business or restricted stock. This gives you more options for donating assets prior to liquidation, paying no tax on the sale, and then reinvesting the proceeds to generate income – potentially for generations

- After the Last Income Beneficiary Dies, Remaining Assets Go to Charity – Not Family – The real question to explore up front is, how much of your estate do you wish to go to your heirs after you are gone? For many clients, this is not an issue with using the (young) PIF. When it is, however, we have been able to use a portion of the tax savings and increased income from the (young) PIF to purchase life insurance on the donors – or even the next generation. Placing the insurance in an “Asset Replacement Trust” allows the donors to replace the value of the assets going to charity, and do so in a vehicle that is protected against creditors, divorce for children and future heirs, Federal estate taxes, etc.

Conclusion: A (Young) Pooled Income Fund May Be Just What You Are Looking for to Reduce Taxes, Receive Income and Do Good for Others Eventually

If you are interested in creating more tax deductions and receiving lifetime income, consider using a (young) PIF. This new generation Pooled Income Fund is one of the brightest tools/techniques for sophisticated clients looking for a better answer to the question, “How can I sell my appreciated asset(s) and not pay taxes on the gain?”

No two clients are the same, however. They all have different needs and goals. Please contact us if interested in learning more about the (young) PIF, or other strategies to reduce your tax bill. At the same time, we can assist in balancing your charitable goals with your financial plans – using money that would otherwise have gone to “involuntary philanthropy” (also known as taxes!) It is possible to do well by doing good …

“Imagine That™”!

Written by R. J. Kelly – December 2018

Read Next:

One of the Best Ways to Cut Your Tax Bill in 2018 and Beyond You Have Never Heard Of!

The Least Understood Aspect of the New Tax Act and Why It Matters!

Does Your Investment Portfolio Have Shock Absorbers?

I Wish I Had Known About This For My Own Mom

Pingback: Five Money Mistakes and How to Avoid Them - Wealth Legacy Group®, Inc.