One of the well-known Christmas songs is the “12 Days of Christmas.” Yes… it gets really boring towards the end, but okay.

One of the well-known Christmas songs is the “12 Days of Christmas.” Yes… it gets really boring towards the end, but okay.

Not sure if you can identify with the lords a-leaping or with the ladies dancing, and for sure not the maids a-milking, but here are 12 tax-smart planning moves for year-end that you may want to consider.

All of these can set you up for a fatter wallet in 2022 and a financially savvy 2023+ … “Imagine That™”?

So … in no particular order … here you go!

First and foremost, start out with a review of your financial and overall life plan. Long-term data and 30+ years of personal experience working with successful entrepreneurs, professionals, executives, and their families have taught me the following: The surest way to sprint off the blocks and cross the financial finish line in triumph (think Rocky theme music here) is to have a thoughtful, specific, well-diversified, holistic financial and life plan.

And, before you can review a financial and life plan, you need to HAVE a financial and life plan! Do you?

If you don’t – or if there is a half-inch layer of dust on your previous plan, what are the areas of your life that you wish to make some specific goals for in 2023?

I use a wonderful free assessment tool and update it quarterly myself. It measures ten different “life domains” with the suggestion to consider creating goals to enhance each domain. Check out the Full Focus Free Assessment here.

Once you have determined what areas of your life you wish to set goals in, Michael Hyatt, New York Times multi-best-selling author, gives us recommendations on how to effectively set goals with the greatest probability of attaining them:

Specific – “Being a better spouse” is not a goal. “Having a date night with my spouse every month!” is … and hopefully will lead to becoming a better spouse as you create opportunities for dialog away from kids, dogs, in-laws, and other distractions!

Measurable – “Losing weight” is NOT measurable. “Losing ten pounds by a certain date by walking 2 miles, 5 days/week” is!

Action-Oriented – “Saving more” is not a goal. “Saving $500/month starting January 15th” is.

Risky – Having a goal that is easily attainable is playing it safe. Instead, what is a goal that will be challenging – difficult – will really stretch you?

Timebound & Time-Keyed – Can you imagine a sporting event without specific starting and ending times? Set a specific date by which you will have achieved your desired goal.

Exciting – Picture achieving your goal – feel the excitement of reaching it, and it will help carry you through the “messy middle,” as Hyatt calls it, when we feel like giving up.

Relevant – Your goals need to be relevant for where you are in your life right now. If you have four children under the age of six, training for a marathon and getting your law degree may not all fit into the same jar at the same time!

These are SMARTER goals to help you grow in the life domains you have selected for yourself. And here’s a helpful video that dives into more detail for all you goal junkies!

Creating a life & financial plan with SMARTER goals that you commit to paper and review regularly will place you in the top 3% for successful life outcomes according to the research. I have my goals printed out and review them at least five out of seven mornings for five minutes. It really does work!

So you have a plan now? Terrific. But, as Mike Tyson famously said, “Everybody has a plan until they get punched in the mouth.” Creating a life & financial plan is a work in progress that can and should be adjusted as your life evolves.

Have there been any significant life changes for you this year? Are any of them so significant that they result in changing your goals or your tolerances for risk or perhaps create a need for greater liquidity?

- Welcomed a new baby/grandbaby into your family (and therefore should consider the financial implications of such?)

- A job change or loss?

- Marriage? Divorce? Death of a loved one?

- Moving to another home or another state (or country)?

- Retirement?

- Has this year’s negative investment environment made you a more conservative investor?

On the last bullet point, when stocks tumble, some investors become very anxious. When stocks post strong returns, others feel invincible and are ready to load up on riskier assets. Be wary of making portfolio changes that are simply based on emotion and reactions to market changes in the moment.

So, if there have been any of the above or other material changes, or even if you just want to go over your goals for 2023, let’s get together right away to make 2023 your best year ever! (Or, at least until 2024!)

2) Harvest Your Losses

Have you had any short- or long-term gains (or losses) this year in your investment portfolio? (Ignore your real estate for this discussion. Those have their own rules to follow.)

In this next idea, let’s explore how to take advantage of a strategy called “tax-loss harvesting.”

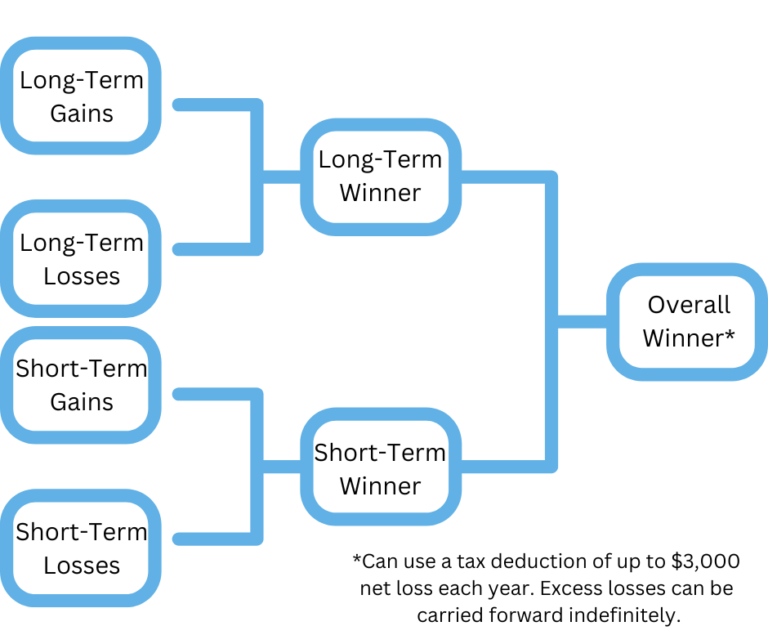

Since this idea can get a little confusing for some, let’s put this into a format that everyone understands … football playoffs and brackets! LOL (Or, at least 50% of Americans understand?)

Think of the brackets of teams heading into the finals. In this case, we take all investments you have held for more than a year and tally up the gains and losses. Same thing for your investments held for a year or less.

At the top of the bracket, we have Team Long-Term Gains versus Team Long-Term Losses. The teams in the bottom bracket are Short-Term Gains vs. Short-Term Losses. The “winners” of those brackets then move to the Finals.

If Team Gains “wins the Cup,” this means that your overall gains exceeded your overall losses. If Team Losses wins overall, then you can carry those losses forward indefinitely to offset against Team Gains in future years. Every year, you can take “suspended losses” (losses sitting in the “penalty box!”) to a maximum net loss of $3,000. Whoo-hoo!

What might this look like?

Let’s say Team Gains racked up $30,000 net profit from the gains of stocks held for at least a year + 1 day. We then look for any losses in assets – again, those held for a year + 1 day or longer. Assuming they have not already been sold (aka realized,) you sell off some or all of those loss positions – or at least enough to offset the long-term gains on your stock you sold for a gain.

We then do the same thing for Team Short-Term Realized Gains and Team Short-Term Realized Losses (again, those assets held a year or less.)

Bottomline, realized losses on investments are used to offset capital gains of the same type. In other words, short-term losses offset short-term gains, and long-term losses offset long-term gains.

What if, net-net, Team Losses overall exceeds Team Gains? Losses can be carried forward to future tax years indefinitely, although as we said above, the net amount of losses cannot exceed $3,000 per year after offsetting all gains.

One word of warning… the “refs” (IRS) will throw a flag on the play for something called the “wash-sale rules.” The wash-sale rule prevents you from taking a loss on an investment if you buy the exact same asset or a “substantially identical” investment 30 days before or after the sale.

For example, this year, several of our significant clients had substantial long-term capital gains. We helped them identify certain assets at a loss that could help reduce their taxes if sold. We moved them to a similar type of investment, but because it’s with a different sponsor (Vanguard to Dimensional Fund Advisors,) we’re safe from the wash-sale rules.

At the end of 30 days, we’ll move their money back to Vanguard. If there are any losses in the substitute short-term bond fund over the 30 days, that just adds to the deduction they can use to offset remaining gains this year or carry over to future years.

All clear? Makes me want to go outside and throw the football around…

3) Tax Loss Deadline

Remember … you only have until December 31 to harvest any tax losses and/or offset any capital gains.

Did you know that you pay no Federal taxes on a long-term capital gain if your taxable income is less than or equal to $41,675 for singles or $83,350 for married filing jointly or qualifying widow(er)?

For this reason, it can actually be smart to sell an asset(s) and take a long-term capital gain. Simply put, you sell the stock, take the profit, and pay no federal income tax. And you could re-invest in the stock, upping your cost basis.

But be careful.

The sale will raise your adjusted gross income (AGI), which means in California at least, you’ll pay at least a little bit of state income tax on the long-term gain.

In addition, by raising what’s called your modified adjusted gross income (MAGI), you could also impact various tax deductions, impact taxes on Social Security, or receive a smaller premium tax credit if you obtain your health insurance from the Health Insurance Marketplace.

So … make sure your CPA runs a comparison of selling vs. not selling before you pull the trigger on realizing any gains. Make sure the “no tax to IRS” on the sale is of greater benefit than paying any taxes into your state coffers.

4) Mutual Funds & Taxable Distributions

Timing is everything… in love and taxes!

That is especially true if you hold mutual funds, for example…

If you buy a mutual fund in a taxable account on December 15 and it pays its annual dividend and capital gain on December 20, you will be responsible for paying taxes on the entire yearly distribution, even though you held the fund for just five days.

It’s a tax sting that can be avoided by simply waiting until the annual distribution is made before buying any new mutual funds. The Net Asset Value hasn’t changed by waiting, and you avoid paying taxes on the year-end dividend distribution.

One further point … there has been tremendous volatility in the stock and bond markets this year. As a result, some actively managed funds may have taxable distributions as much as 20% of the fund value this year, even though the Net Asset Value of the fund is likely down significantly since the beginning of the year. So … be prepared.

5) Don’t Forget the Required Minimum Distributions

Ah yes … if you are 72 years or older, an annual Required Minimum Distribution (RMD) must be taken from your retirement accounts (with the exception of Roth IRA’s.) So, this next idea relates to taking your RMDs.

If you turned 72 in tax year 2022, you have until April 1, 2023, to take your first RMD. Pushing your 2022 distribution into 2023 will reduce your taxable income in 2022. Bear in mind, however, that you will be required to take two RMDs in 2023, potentially pushing you into a higher tax bracket next year.

If you miss the deadline to withdraw your RMDs in a timely fashion, you could be subject to a 50% penalty on the portion of your RMD you failed to withdraw. Ouch!

For all subsequent years, including the year in which you took your first RMD by April 1, you must take your RMD by December 31.

Buckle-up for a quick second as we get into a few technical things you will probably want to be aware of.

- The RMD rules apply to traditional IRAs (IRA-based plans such as SEPs, SARSEPs, and SIMPLE IRAs)

- The RMD rules also apply to ALL employer-sponsored retirement plans, including profit-sharing plans, 401(k) plans, 403(b) plans, and 457(b) plans. (Whew … who knew?)

- The RMD is ALSO required from a Roth 401(k) account, even though the RMD rules do NOT apply to Roth IRAs while the owner is alive

Many of the rules have changed in the last few years regarding the taking of RMDs for beneficiaries. That is, when must a beneficiary begin taking distributions, or how long can a beneficiary(ies) defer using their own age? It has become a very complicated area. We should sit down and discuss your unique situation as to which “path” to take considering the source of the money – age/health of the owner and beneficiary(ies).

I know some of you clever people out there are asking, “Well, how are RMDs even calculated?”

Great question!

An RMD is calculated for each account by dividing the prior December 31st balance of that IRA or retirement plan account by a life expectancy factor published by the IRS.

(Are you sorry you asked?)

Also, if you continue working past age 72, there is bad news and good news. The bad news is you are required to take your RMD from your IRA. The good news, thanks to the SECURE Act, you can still contribute money to your retirement account(s) for as long as you have earned income.

One more thing … what if you continue to work past age 72 and do not own more than 5% of the business you work for? Most qualified plans, such as 401(k)s, etc., allow you to postpone RMDs from your current employer’s plan until April 1st of the year after you finally stop working!

Head hurt yet? I promise, the next one is an easier one to consider…

6) Maximize Your Retirement Contributions

How can you maximize your retirement contributions? What are the limits?

There are a number of different retirement plan options, but for today’s newsletter, we’re just going to look at the most common types of plans.

401(k)s

If you are a participant in a 401(k) plan, you can reduce income taxes during the current year. In 2022, the maximum contribution for 401(k)s and similar plans is $20,500 ($27,000 if age 50 or older, and if permitted by the retirement plan).

IRAs

In 2022, the maximum you can contribute to an IRA is $6,000 ($7,000 if you are age 50 or older). Contributions may be fully or partially deductible depending on how much you earn.

A Roth IRA doesn’t allow you a tax deduction in the year of the contribution, but it does allow the money to grow tax-free – not just tax-deferred! Further, Roth IRA withdrawals are tax- and penalty-free when the Roth IRA rules are met.

Total contributions for all accounts cannot exceed the prescribed limit. You can have, for example, a traditional IRA and Roth IRA and contribute to both in the same year. The combined contributions, however, cannot exceed the IRA limit.

As a reminder, you must have earned income to be able to contribute to retirement accounts. Just because you earned $100,000 in interest, does not mean you get to defer any of that into an IRA, 401(k), etc. You or your spouse if filing jointly must have taxable compensation.

While there are certain exceptions, IRA contributions must be made by the tax filing date of the following year. (e.g., April 18, 2023, for tax year 2022.) And be aware that statewide holidays can impact the final date as well.

Multiple Plans

A closing thought on this section. Have you thought about adding a second type of plan to allow you to put more money away? Especially if you are owners or partners of a business – or maybe you are a one-person business – you can put away more money than just through your 401(k) alone!

Until the advent of 401(k) plans, the typical business-sponsored retirement plan was a pension plan. Usually, the pension plan allows for more money to be contributed for older, more highly compensated employees. It’s a way to both make sure you’re taking advantage of tax-favorable retirement strategies and compensate/retain your top employees.

We just implemented a second plan ourselves last year and are contributing a significantly greater amount pre-tax than just through the 401(k). These kinds of plans (such as a “Cash Balance Pension Plan”) are more complicated… but can be well worth it if you are looking for more tax deductions and greater future income in retirement!

7) IRA Conversions

Because the investment market is down for the most part, 2022 could be the perfect year for converting your traditional IRA to a Roth IRA … or at least some of your IRA.

You’ll pay ordinary income taxes on the converted portion of the IRA. But going forward, you won’t have an RMD requirement (based on current law), growth is tax-deferred, and if you meet certain requirements, you’ll avoid federal income taxes when you withdraw the funds.

A Roth may make sense if:

- You won’t need the money for several years

- You believe you’ll be in the same or higher tax bracket at retirement

- You won’t need to use retirement funds to pay the taxes

Once converted, you cannot ‘recharacterize’ (convert back to a traditional IRA). The deadline to convert is December 31.

8) Charitable Giving

Unless you live under a rock or outer Mongolia, most people know you can donate cash, stocks, bonds, mutual funds, ETFs, real estate, etc. to your favorite charity(ies) by December 31st and reward yourself with a handsome tax deduction (plus do something really great in helping others less fortunate!)

But… have you heard about the “qualified charitable distribution” (QCD) if you are 70½ or older?

A QCD is an otherwise taxable distribution from an IRA or inherited IRA that is instead paid directly from the IRA to a qualified charity. It is especially advantageous if you do not itemize deductions.

If you are a single taxpayer, you can contribute $100,000 per year to a charity or charities. If you file jointly, you and your spouse can each make up to a $100,000 QCD gift directly from your IRA accounts yearly. Magical!

As well, making a gift to charity(ies) from your IRA also satisfies your required minimum distributions if you’re age 72 or older. It just gets better and better!

You might also consider something called a Donor-Advised Fund (DAF). Once the donation is made, you can realize immediate tax benefits in the year you make the contribution to your DAF.

Even though you get the entire deduction in the year of contribution, you decide when and to which qualified charity(ties) you will make donations from your DAF. Put another way, there is no required minimum distribution from your DAF in a given year.

How about double dipping? It is possible to donate appreciated assets on which you have never paid taxes and receive a deduction for the full fair market value of the asset! For example, a $50,000 contribution of appreciated stocks/mutual funds, etc., can give you a deduction this year on an asset with gains you have never paid taxes on.

There are special rules to consider, but overall, this is a great combination of strategies to help you save taxes this year… while also creating a bucket to use for future giving.

Real estate can also make a wonderful asset to gift away… but there are special situations that limit your deduction to only your cost basis. Let’s have a chat before gifting real estate to make sure to maximize your deduction!

9) Check Your Insurance Coverage

Take stock of changes in your life and review your insurance. Let’s be sure you are adequately covered. At the same time, it’s a good idea to update beneficiaries to reflect changes in life and status. Do you have enough – too much – so forth?

I once obtained a new client after reviewing his trust document and noted that his ex-wife of four years was still the beneficiary of his estate! Almost a big oops there (unless you are the ex-spouse, of course.)

A quick year-end review of your insurance plans can help make sure you’re protected from whatever 2023 brings. Check your:

- Life

- Health

- Disability

- Home/Renters

- Vehicle

- Umbrella

- Umbrella Liability

- And…

Eighty-three percent of Americans will suffer a long-term care event at some point in their life. One often overlooked insurance coverage every American, therefore, should consider is something called long-term care insurance. Even for those who are wealthy or affluent, I have seen many buy long-term care insurance of a certain type and amount. It is strictly a math conversation.

Do the benefits outweigh the cost? Even for many affluent families, the answer is “yes.”

We use an outside specialist that just focuses on this area as it is extremely complicated, and the options are more prevalent than in prior decades. (Thanks to us Baby Boomers who “want more options!”) Let’s have a chat if you don’t have long-term care coverage or if you do have some already but it needs a review.

10) Put Your Children on Your Payroll

If you have a child under the age of 18 and you operate your business as a “Schedule C” sole proprietorship or as a spousal partnership, you could consider having that child(ren) on your payroll. Why?

- Neither you nor your child will pay payroll taxes on the child’s income

- Every person gets a $12,950 personal exemption from taxes

- Traditional IRA’s allow for an annual tax-deductible contribution of $6,000 (in 2022)

- Thus, each child can avoid all federal income taxes up to $18,950 of earned income by contributing the $6,000 maximum to their own traditional IRA ($6,500 in 2023)

- If the earnings are 12,950 or less, the child could open a Roth IRA and contribute after-tax up to $6,000 ($6,500 starting in 2023).

Even if you operate your business as a corporation, you can still benefit by employing your child(ren) through your corporation but your child(ren) will need to pay payroll taxes.

11) Is There A December Wedding In Your Future? (Or Divorce?) Know The Rules!

Although lawmakers have made many changes to eliminate the differences between married and single taxpayers, the joint return will work to your advantage in most cases.

So, if you are planning on tying the knot, you might consider getting married on or before my birthday – oh, that’s December 31st, and simple gifts of cash are quite acceptable! (I am kidding… mostly.) The IRS allows you to treat your incomes as if you were married for the entire year, even if you end up exchanging your vows as the mirror ball drops!

To determine your tax benefits (and detriments), it would be best to have your CPA run the numbers for you. If the math works out, there may be a quick trip to the courthouse in your future!

The opposite is also true. If things are rocky in the nest, hang in there at least until New Year’s Day and get the favorable tax benefits of being married for one more year! (Hopefully, things will work out, and you’ll stay married for more than just tax relief!)

Be aware … the Tax Cuts and Jobs Act of 2018 changed the tax treatment of alimony payments under divorce and separate maintenance agreements executed after December 31, 2018:

- Under the old law, the payor would deduct alimony payments, and the recipient would have to include the payments in income

- Now, the new law applies to all agreements executed after December 31, 2018. The payor gets no tax deduction, and the recipient does not recognize income

12) Make Use of the 0% Tax Bracket

Do you give money to your parents or other loved ones to help make their lives more comfortable?

If the answer is yes, is your loved one in the 0% capital gains tax bracket? The 0% capital gains tax bracket applies to a single person with less than $41,675 in taxable income or to a married couple with less than $83,350 in taxable income.

If your parent or other loved one is in the 0% capital gains tax bracket, you can utilize some “tax judo” by giving this person appreciated stock or other appreciate assets rather than giving cash.

Example. You give Mom shares of stock with a fair market value of $20,000, for which you paid $2,000. Mom sells the stock and pays zero capital gains taxes. She now has $20,000 in after-tax cash, which should take care of things for a while. (And, it might land you something more than another pair of knitted socks at Christmas!)

Had you sold the stock yourself, you would have paid federal long-term capital gains taxes of $4,284, assuming 20% long-term capital gains tax plus the 3.8% Medicare surtax. (23.8 percent Federal tax * $18,000 gain). Recognize many states have a tax in addition to the federal tax. In California, that tax rate most likely would be 8-10% more.

Do be aware that $4,000 of the $20,000 you gifted goes against your $12.06 million estate tax exemption if you are single. But if you’re married and made the gift together with your spouse, you each have a $16,000 gift-tax exclusion, for a total of $32,000, and you have no gift-tax concerns other than the requirement to file a gift-tax return that shows you split the gift.

Also, in the old days, you could use this strategy with your college student. Today, this income-shifting idea won’t work with that student because something called the “kiddie tax” now applies to students up to age 24. If you make a gift of assets to a child below the age of 24, IRS uses the tax bracket of the parent and not the child’s if the asset is sold. No tax judo to be used here!

And a Partridge in a Pear Tree…

I hope you’ve found this review to be educational and potentially useful. Once again, let me gently remind you that before making decisions which may impact your taxes, it is best to get a second opinion. If you have any questions on the above or would like to discuss any other matters, give us a call at (858) 569-0633.

To give you a head start, the new 2023 retirement allowances are as follows:

- 401(k) – $22,500

- 401(k) with the age 50 and over catch-up provision – $30,000

- IRA – $6,500

- IRA with age 50+ catch-up – $7,500

As always, I’m honored and humbled that you have given me the opportunity to serve as your financial advisor. (And, if we aren’t yet … how about giving us a shot in 2023?)

Let’s get prepared to start of 2023 with a great financial (and life) plan and SMARTER goals to get started on a great year…“Imagine That™!”

(See P.S. below if you have crypto or someone you know has questions … )

P.S. A Quick Note on the Crypto Crash

Stocks have been battered by the Federal Reserve’s quest to rein in the highest rate of inflation in 40 years.

So far, however, investors have expressed little concern over the crisis that has rocked cryptocurrencies. It’s a far cry from the reaction to Lehman’s demise in 2008, which sparked the financial crisis and nearly wrecked the global financial system.

Table 1: Key Index Returns

| MTD % | YTD % |

Dow Jones Industrial Average | 5.7 | -4.8 |

NASDAQ Composite | 4.4 | -26.7 |

S&P 500 Index | 5.4 | -14.4 |

Russell 2000 Index | 2.2 | -16.0 |

MSCI World ex-USA** | 10.5 | -16.1 |

MSCI Emerging Markets** | 14.6 | -21.1 |

Bloomberg US Agg Total Return | 3.7 | -12.6 |

Source: Wall Street Journal, MSCI.com, MarketWatch, Bloomberg

MTD returns: October 31, 2022-November 30, 2022

YTD returns: December 31, 2021- November 30, 2022

*Annualized

**in US dollars

Investing in cryptocurrencies is highly speculative. For instance, legendary investor Warren Buffett has not been shy about expressing his disdain.

A couple of years ago, Buffett said, “Cryptocurrencies basically have no value, and they don’t produce anything….

They don’t reproduce, they can’t mail you a check, and what you hope is that somebody else comes along and pays you more money for them later on, but then that person’s got the problem. In terms of value: zero.”

I personally bought some crypto with the expectations I would/could lose it all. I simply wanted to have some skin in the game to see what I could do with it and how it worked.

Bitcoin, the oldest and best-known cryptocurrency, was trading around $65,000 a year ago. Last month, it dropped below $16,000 (MarketWatch).

Earlier in the year, TerraUSD, which is a ‘stablecoin’ that used algorithms to peg its value to the dollar, worked well— until it didn’t and collapsed.

Crypto trading platforms such as FTX and Celsius Network are languishing in bankruptcy, rocked by the digital version of bank runs and a lack of liquidity. Those who hold funds with the likes of FTX, whose demise is being compared to the collapse of Enron, can no longer withdraw funds and may never see their investments again.

And it’s not simply investors. Celebrities who lent their names to some of these platforms are feeling the fallout through soured investments and lawsuits.

But the storm that descended upon the crypto world has barely made a ripple in traditional financial markets and finance.

“Crypto space…is largely circular,” Yale University economist Gary Gorton and University of Michigan law professor Jeffery Zhang write in a forthcoming paper.

“Once crypto banks obtain deposits from investors, these firms borrow, lend, and trade with themselves. They do not interact with firms connected to the real economy.”

In other words, the dominoes that fell in crypto only knocked down other crypto dominoes.

A recent article in the Wall Street Journal suggested the crisis may have done the economy and equity investors a favor, notwithstanding losses for those in crypto. Eventually, traditional firms and investors would have embraced an industry that lacks regulatory controls. An implosion several years from now could have had far different consequences.

So, my take on it is this: Crypto has a place in a portfolio … but a very limited one. It is simply a volatile “alternative investment” and is here to stay as national borders get more and more fluid. Like any other asset class, it has positive and negative attributes. I am not selling my crypto even though I have lost approximately 50% of its value … for now at least. I will continue to add a small amount monthly, but I am not planning on retiring on my “crypto riches” … at least not any time soon (or ever!)

And, if you REALLY want to have a fascinating conversation about crypto and its future uses and viability, I will be happy to introduce you to my “grand master,” Lou, who has forgotten more about crypto than others have ever known!

Imagine That™! is a complimentary monthly newsletter provided by Wealth Legacy Group®, Inc. that addresses various topics of interest for high-net-worth and high-income business owners, professionals, executives and their families. Sign up to receive our monthly newsletter here.

R. J. Kelly, CAP, ChFC, CEPA, CLU, MSFS, RICP, IAR, AEP, WMCP, Wealth Legacy Group®, Inc. – December 2022

Image on Canva, one design use license